In this article I am going to talk about working with CPA affiliate networks and how they fit into performance marketing and the pros and cons of working with those networks.

Table of Contents

So let’s first talk about what is a CPA affiliate network and how do they fit into performance marketing.

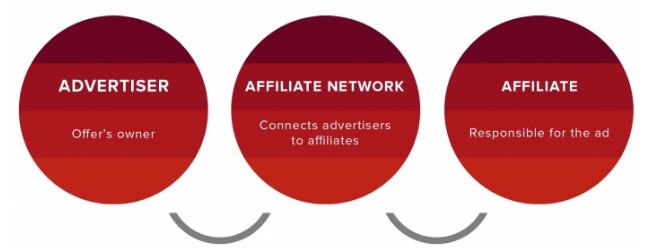

Let’s talk about the three key players of affiliate marketing.

So we basically have the merchant or the advertiser, they own the products or services that are being sold online. They’re also the company that may pay for leads for their company if you generate leads for them.

So these people are the company, the advertiser merchants actually are the ones that have the money after the customer has given it to them.

So they are the purse strings, we’ll say in the performance marketing industry.

Advertisers/Merchants can pay directly to affiliates or they can pay into a CPA affiliate network.

Advertisers take their offers or their services and they put them onto a network so that affiliates can actually get those offers to promote.

The network acts as a middleman between the advertiser and the actual affiliates. The network is in between, and the reason why people work with affiliate networks is what we’re going to talk about next.

Why Do Affiliates Work With a CPA Affiliate Network? 5 Advantages

1. Multiple Merchants

Working with affiliate networks allows you as an affiliate to get access to multiple offers available from different advertisers.

The network does all the work and gets the advertisers from around the world into their network so that you as an affiliate can just join the network. When you’re in a network you have access to hundreds, sometimes thousands of offers to choose from.

2. You often get an affiliate manager.

Affiliate managers can be helpful at times, but sometimes they’re not very helpful at all. When you find a good affiliate manager, make a good relationship with them in order to find new ideas for your campaigns.

3. Faster and more consistent Payments

Networks generally promote that they have sufficient cashflow so that they guarantee they will pay affiliates when the advertisers don’t pay.

In this industry there are advertisers that definitely do not pay. Sometimes this happens when their credit card processors get frozen, maybe a legal issue, or they just decided to jump ship and not pay the networks for whatever reason.

Networks are supposed to protect you from that since they have the cash flow and this reduces your chance of getting stiffed by an advertiser.

4. Exclusive offers.

Many CPA networks have exclusive offers that you can get and these are offers that are only available if you work through a network.

You can’t actually work direct because they have a contract in place which is usually called Agency on Record or (AOR).

5. Being part of a community

As a member on a network you receive newsletters and information about the industry. If you’re on a good network, many networks will send updates and new offers that are available and they’ll keep you posted on what’s happening in the industry.

If you were to work directly with an advertiser, many times you’re not going to see everything that’s happening inside the performance marketing industry. Advertisers will only be send information related directly to their products.

If you’re on a network, you’re going to see a lot of information about different products. This keeps you informed about what’s happening in the industry.

What Are the Cons Of Working With CPA Affiliate Networks?

One of the cons of working with a CPA network is that they are the middle man or the middle entity that is between you and the advertiser.

Networks are always going to get a commission. So if you are a large affiliate and you’re spending tons of money every single day and you’re getting thousands of conversions, the network will get 10% or 20% of the total revenue.

Another con is that the network sees what everyone else is doing. Some networks and their affiliate managers will actually share what you’re doing with other affiliates. If you find something that’s really working well, it is possible that your affiliate manager could actually find that and share it with others in their network.

Those are a couple of the major risk factors of working with a network.

Now let’s talk about some of the things you’re going to look for in your network to make sure that they’re stable and that they are a good network.

Late on Payments

If you have a payment owed to you and the network doesn’t pay it exactly on time, on the day they say they’re going to pay it, there’s something going on there. You need to find out why your payment was late. Talk to your affiliate manager, ask them why and understand what happened. Sometimes it’s just because your payment method wasn’t updated in the system and that is normal. This happens, and there’s automated systems in place that sometimes fail.

If the reason for late payment has anything to do with “we’re waiting for a wire from the advertiser”, you know that means that they don’t have a sufficient cash flow.

That is a huge risk factor and it means that you need to get off that network as soon as possible if there’s any sign that they don’t have a good cash flow.

Another risk factor to consider is when the network will not budge on a net 30 or a monthly payment.

If you’re generating really high amounts of good quality traffic and they’re not willing to budge to a weekly payment or even sooner, sometimes this means you are on a network that is probably experiencing some cash flow problems. You need to look for another network that is willing to accommodate faster payments for you.

Some of the bigger advertisers will only pay net 30 and that is why it is an advantage to work with the network because the network will usually front you the cash while they’re waiting for the advertiser to pay them.

Another risk factor is if there’s constant tracking issues, this means that they are sloppy.

Affiliate networks set up offers but if they’re not setting up tracking and testing the offers before they get them to affiliates, this means they’re sloppy and can result in a lot of missed conversions.

It could also mean another thing which I talked about in one of my videos about shaving or throttling.

If you get conversions, it’s possible that sometimes a network may shave. Even the advertisers have the ability to do this, but there’s really no advantage to that.

Most of the time affiliates are not really getting shaved. It usually comes down to a tracking issue. So make sure if you’re having a lot of tracking issues that you consider looking into why this is happening.

Is it because of a network failure?

You want to look for networks that are truly willing to help you. There are tons of extremely popular networks out there that you can trust. Just go online, look on Facebook, search around.

You’ll see these networks in many of the major groups or even ask in Facebook groups as to whether these affiliate networks are trust-able.

Now there’s a ton of networks out there, so be careful. There’s a whole bunch of people that run networks that aren’t really networks.

You’re looking for a company, somebody that has employees offices and are known to pay on time.

Conclusion

So hopefully this post has helped you in understanding how the network fits into the grand scheme between the advertiser and the affiliate.

Have you had any good or bad experiences with CPA affiliate networks? Please post them below!

There are good things and bad things about a network. I work with many networks. Today. I work with at least 10 CPA affiliate networks. So there’s absolutely nothing wrong with working with a network.

- How to Make $1000 a Day With Google Ads Affiliate Marketing – Ultimate Guide - October 10, 2023

- Ultimate Guide to YouTube Shorts Ads for Affiliate Marketing - December 23, 2022

- How To Start Affiliate Marketing For Beginners [Ultimate Guide 2023] - December 21, 2022